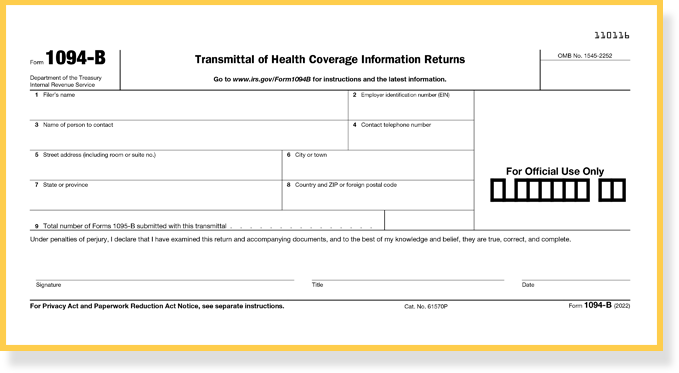

You will need to file Form 1095B only if your company is not considered an applicable large employer and isTax Form 1095C is a document that contains detailed information about health care coverage offered to applicable employees The ACA has mandated that employers provide Tax Form 1095C to all eligible employees as of 16 (for tax year 15) Tax Form 1095C serves as proof of insurance, and is formal documentation of ACA compliance for the IRSDoes Zenefits help with 1094B and 1095B forms?

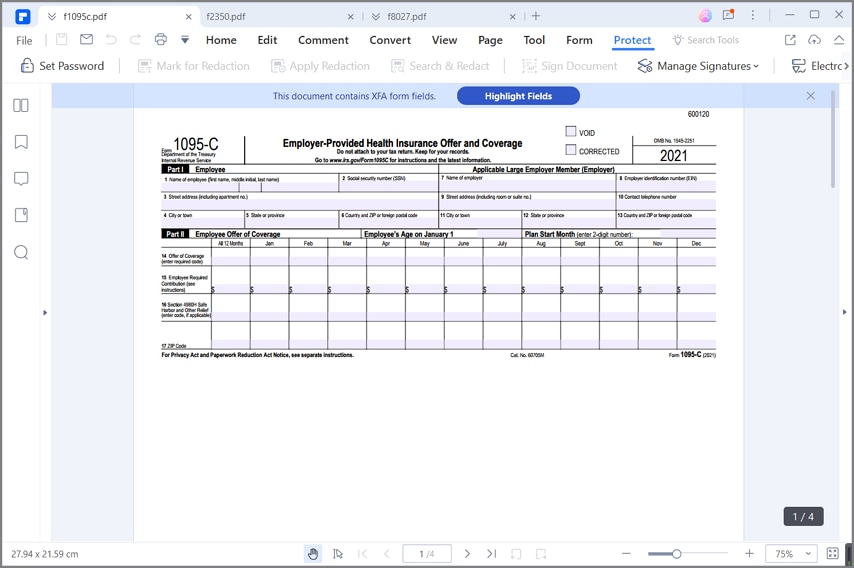

Form 1095 C Employer Provided Health Insurance Offer And Coverage Editorial Image Image Of Federal Coverage

1095 c tax form definition

1095 c tax form definition- Many people will receive the IRS Form 1095C this year, and there is plenty of confusion about it and its sister forms, 1095B and 1095A Consumer Reports explains what they are and what to do IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you by

Questions Answered For Mastering The 1095 C Form Blog Tango Health

Code 1A alert On , the IRS revised ACA reporting guidance on how employers document a qualifying offer of health coverage on Form 1095CForm 1095C is used to report information about an individual employee Employers that offer employersponsored selfinsured coverage also use Form 1095C to report information to the Internal Revenue Service (IRS) and to employees about individuals who have minimum essential coverage under the employer planForm 1099C (entitled Cancellation of Debt) is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report various payments and transactions, excluding employee wages

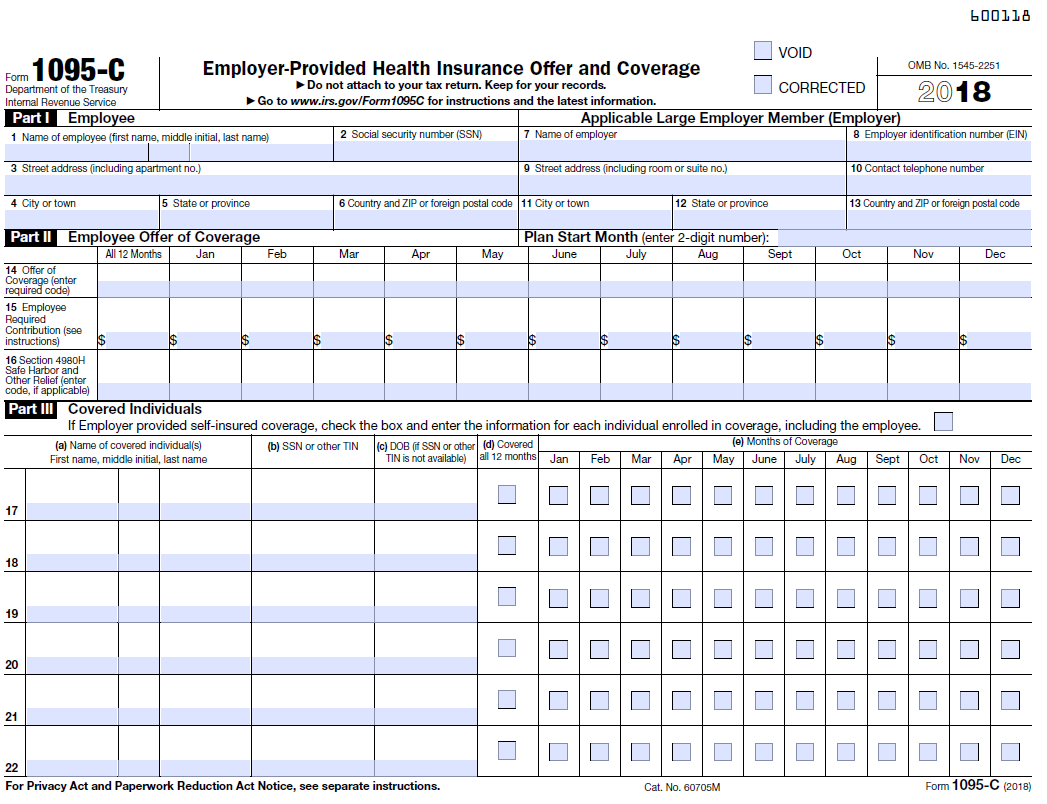

When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095CHow can I find my company's ACA measurement period?The Form 1094C and associated Form(s) 1095C This simple element is required if the xml includes USAddressGrp USZIPExtensionCd Line 6 USZIPExtensionCdType string pattern 09{4} 0 1 Optional USZIPExtensionCd is the 4digit extension zip code for the address of the filer that is filing the Form 1094C and associated Form(s) 1095C

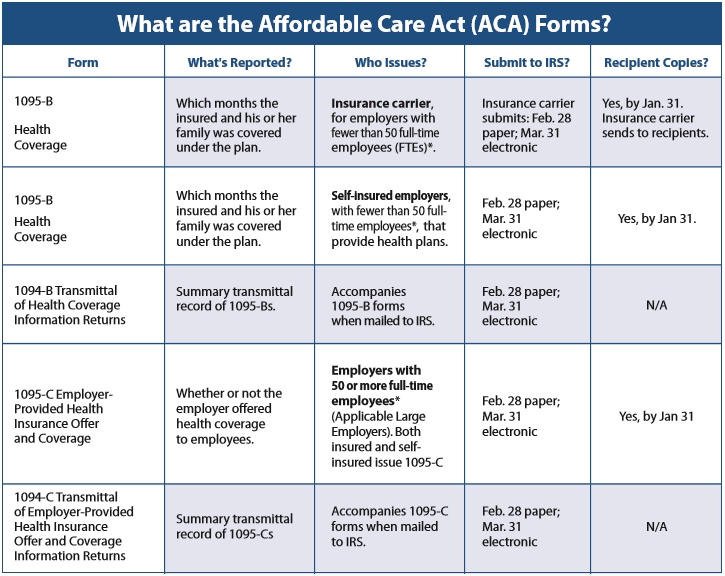

Definition and Examples of Form 1095A Form 1095A Health Insurance Marketplace Statement is provided to taxpayers who purchased health insurance through a health insurance marketplace carrier It's used to report health insurance coverage to the IRS IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095CForm 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees

Irs Form 1095 C To Be Distributed Hub

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Form 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility "Safe Harbor" provisions of Section 4980H The table below explains the code series 2 to be reported on line 16 of Form 1095C During the IRS group call on for developers of Affordable Care Act reporting software, a presenter for the IRS technical team brought clarity to Form 1095C reporting for a Qualifying* Offer of coverage In short, we now have a Code 1A alert, because the new information is a significant departure from previous guidance for, and interpretations of, the code IRS Form 1095C Draft was released for the 21 Tax Year with changes What are the Changes to Form 1095C?

Does Your Company Need To File Form 1095 B Turbotax Tax Tips Videos

Hr Updates Theu

How can I create a report with addresses for terminated employees?Form 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselves

Form 1099 Nec For Nonemployee Compensation H R Block

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

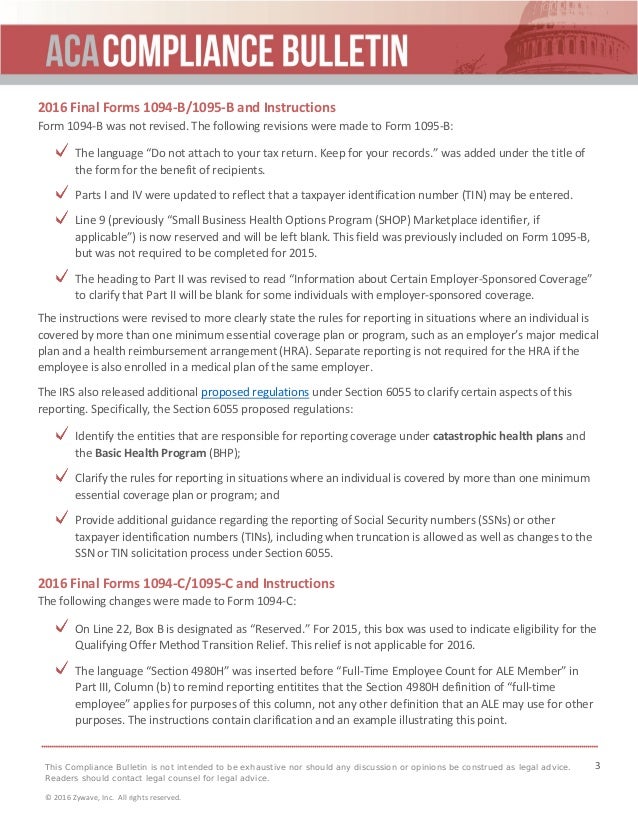

Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out On Form 1095C, the language "Do not attach to your tax return Keep for your records" was inserted under the title of the form to inform the recipient that Form 1095C should not be submitted with the return Other minor clarifying changes were made to both forms The IRS also proposed changes to the Form 1095C Series 1 and 2 indicator codesForm 1095C is used by qualifying employers with 50 or more fulltime employees (including fulltime equivalents) that are subject to the employer responsibility provisions of the ACA Form 1095C contains information about the offer of health insurance coverage to employees and their

3

Code Series 2 For Form 1095 C Line 16

Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return16 Final Forms 1094C/1095C and Instructions The following changes were made to Form 1094 C On Line 22, Box B is designated as "Reserved" For 15, this box was used to indicate eligibility for the Qualifying Offer Method Transition Relief This relief is not applicable for 16 Form 1095A Definition Form 1095A is the Health Insurance Marketplace statement or Form 1095C (for employersponsored coverage) Form 1095A is only for those with Marketplace coverage With the information on Form 1095A, you'll be able to complete Form

2

What Is Form 1095 C And Do You Need It To File Your Taxes

Form 1095C IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement The Section 6056 reporting requirement relates to the employer shared responsibility/play or pay requirement Information from Form 1095C will also be used in determining whether an individual is eligible for a premium tax creditWhen is the filing deadline for forms 1094C and 1095C?Nevertheless, "the Governmental Unit must ensure that among the multiple Forms 1094C filed by or on behalf of the Governmental Unit transmitting Forms 1095C for the Governmental Unit's employees, one of the filed Forms 1094C is designated as the Authoritative Transmittal and reports aggregate employerlevel data for the Governmental Unit, as required in Parts II, III, and IV of Form 1094C

Your Complete Guide To Aca Forms 1094 C And 1095 C

2

If there is only one 1094C being filed for an employer's 1095C forms, that form is identified on Line 19 as the Authoritative Transmittal If multiple 1094C Forms are required to file an employer group's 1095C Forms, one of the Forms 1094C must assume Authoritative Transmittal in Line 19 and report aggregate employerlevel dataDoes Zenefits provide form 1095c to my employees?Completion of the 1095C for state employee insurance

Irs 1095 C Form Pdffiller

Ecommerce Issisystems Com

IRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland singleIn 16, the IRS' Form 1095C document debuted to accompany the W2 form used to file your taxes The Affordable Care Act (ACA) requires large employers (ie, Loyola University Chicago) with 50 or more fulltime employees to offer health insurance to their employeesThe individual does not need to send Form 1095

Aca Reporting Tip 22 Aggregated Ale Groups Controlled Groups Usi Insurance Services

2

If using this code, then use of code 1A on Form 1095C, line 14; The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are ApplicableForm1095C) provides both you and the IRS information about the health insurance coverage offered to you and, if applicable, your family What is the definition of the codes on my 1095C?

Changes Coming For 1095 C Form Tango Health Tango Health

Form 1095 C Employer Provided Health Insurance Offer And Coverage Editorial Image Image Of Federal Coverage

The IRS has added two new codes on Line 14 of the ACA Form 1095C for meeting the mandated ICHRA Reporting Requirements! Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penalties It is often referred to as the "transmittal form" or "cover sheet" IRS Form 1095C will primarily be used to meet the Section 6056 reporting requirement, which relates to the employer shared responsibility/play or pay requirement The 1095C form is a new federal reporting requirement created as a result of passage of the Affordable Care Act (ACA) Employers who must comply with the new health law are required to provide a 1095C form to certain employees and then file copies with the IRS

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

1095 C Form Official Irs Version Discount Tax Forms

With so many changes with the new Affordable Care Act or ACA, we are just beginning to understand the bigger picture of it all Check out this video for mor The employer mandate and the annual reporting requirements (Forms 1094C and 1095C) apply to this Aggregated ALE group and each ALE member as follows Each separate employer (Company A, Company B, and Company C) in an Aggregated ALE group is subject to the employer shared responsibility provisions as collectively they employee at least 50 FTEs in the All applicable large employers (ALE) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095B

2

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

IRS Form 1095C Definition khái niệm, ý nghĩa, ví dụ mẫu và cách dùng IRS Form 1095C Definition trong Thuế Luật & quy định về thuế của IRS Form 1095C Definition / IRS Form 1095C Definition This furnishing relief also extends to Form 1095C for employees enrolled in an ALE's selfinsured health plan who are not fulltime employees for any month in Extension of good faith relief for reporting and furnishing – The IRS will not impose a penalty for incorrect or incomplete reporting on Forms 1095B and 1095C provided there is a good faith effort toAll ALEs need to submit this form (Parts I, II, and III) even if they do not offer insurance and are not selfinsured and they still have to provide a copy of the 1095C to their employees Lines 1417 on the 1095C The bulk of the work in completing the 1095C is with Lines 1417 in Part 2

2

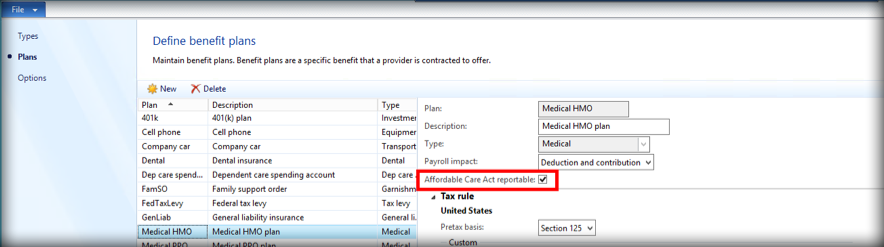

Setting Up Aca Form 1095 C Reporting In Dynamics Ax 12 And D365 In The Know Solutions Group

Can I Request an Extension to File Forms 1094C and 1095C to the IRSForm 1095 is sent to the individual by whoever provides them with health insurance, be it the health insurance marketplace for Form 1095A, a small selffunded group or small business for Form 1095B, or by their (50 fulltime employees) employer for Form 1095C Form 1095 is only sent to the individual and for his or her own reference;Form 1094C requires information including how many people you employ and how many Forms 1095C you are filing Read more about Form 1094C on the IRS website Generally, each FEIN will have its own Form 1094C What about Form 1094B?

Irs Tax Forms Wikipedia

What Is An Irs 1099 Form Definition Form Differences The Turbotax Blog

On the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and for simplicityDefinition Data Extract ID Assign a Data Extract ID for each set of data extract rules Data Extract ID 1094C1095C is system delivered for extracting employer and employee data for Forms 1094C and 1095C Data Extract Options Common As of Day in Month Select the common date to be used for effective date extract of all monthly dataOr alternatively, use one of the different offer codes for Form 1095C, line 14 and on line 15 the dollar amount required as an employee contribution for the lowestcost employeeonly coverage providing minimum value for that month C 4980H Transition Relief a qualifies if either i

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Sandiegounified Ss18 Sharpschool Com

Form 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainlandKeep in mind, if you have a selfinsured plan, a Form 1095C is required for all fulltime employees, as well as anyone who had coverage through your plan, so there may be situations where you are required to produce a 1095C for individuals that do not meet the ACA fulltime employee definition that identifies those employees for whom you have an employer shared responsibility

1095 C 18 Public Documents 1099 Pro Wiki

2

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

1

Aca Compliance Bulletin Final Form For Aca Reporting

Updates To Form 1095 C For Filing In 21 Youtube

2

Ez1095 Software How To Print Form 1095 C And 1094 C

Tax Forms Irs Tax Forms Bankrate Com

Affordable Care Act Aca Forms Mailed News Illinois State

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Erp Software Blog

/88305472-ACA-reporting-56a0a45f5f9b58eba4b25f4a.jpg)

Health Care Law Reporting Requirements For Employers

Template Letter To Employees About Irs Forms 1095 B And 1095 C

15 Banner Year End U S Regulatory Release Presented By Barbara Bates Jan Wilder Kim Johnson And Charles Westfall Pdf Free Download

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Free 1095 C Resource Employee Faqs Yarber Creative

What Is A 1095 C Erp Software Blog

Employer Reporting Of Health Coverage Presented By Carly

Irs Form 1095 C Uva Hr

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Instructions For Forms 1095 C Taxbandits Youtube

Covered California Ftb 35 And 1095a Statements

Employee Benefits At The Top Us Financial Companies Quartz At Work

Large Employers What Are The Deadlines For Forms 1094 C And 1095 C Mitchell Wiggins

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Issues Draft Form 1095 C For Aca Reporting In 21

1095 C Print Mail s

1095 C Reporting Determining A Company S Ale Status Integrity Data

1

The Affordable Care Act S Employer Mandate Part 4 Blog Mma

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Changes Coming For 1095 C Form Tango Health Tango Health

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

What Are The Differences Between Form 1095 A 1095 B And 1095 C

Tom Mcdonald Presentation For July 5 Aca Ppt Download

2

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Aca Code Cheatsheet

2

What Is 1095 C 7 Faqs To Better Understand Irs Form 1095 C

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

Ez1095 Software How To Print Form 1095 C And 1094 C

Questions Employees Might Ask About 1095 C Forms Bernieportal

2

What Is An Irs Form 1095 C Boomtax

1

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Good Faith Definition In Irs Form 1095 C Instructions Erp Software Blog

Understanding Irs Forms 1095 A 1095 B And 1095 C

What You Need To Know About Forms 1094 1095

Sample 1095 C Forms Aca Track Support

Irs Issues Draft Form 1095 C For Aca Reporting In 21

1095 C Form Official Irs Version Discount Tax Forms

Form 1095 C How To Discuss

What Is Form 1095 C And Do You Need It To File Your Taxes

1095 C Template Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Sample 1095 C Forms Aca Track Support

Questions Answered For Mastering The 1095 C Form Blog Tango Health

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Edit An Aca Status

Irs Form 1095 C Fauquier County Va

Palmspringsca Gov

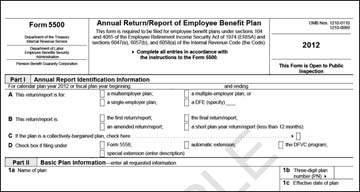

Form 5500 Erisa Plans With 100 Or More Participants Are Required

2

Sample 1095 C Forms Aca Track Support

2

Leyva Eesd Org

Employersresource Com

2

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Form 1095 C Guide For Employees Contact Us

The Codes On Form 1095 C Explained The Aca Times

1095 C Form 21 22 Finance Zrivo

0 件のコメント:

コメントを投稿